Kathmandu. The arbitrariness of listed companies has increased as the Nepal Securities Board has been playing around. In the preamble to the Securities Act, the Board, which is responsible for regulating and managing the issuance, purchase, sale and exchange of securities to mobilize the necessary capital for the country’s economic development and protect the interests of investors investing in securities by developing the capital market, has become weak in its guardianship role.

One of the main reasons behind this is the silence and playful attitude of the Board in the announcement of right shares that are against the law. In recent days, listed companies have been using the issuance of right shares as a weapon to increase the secondary market price of securities. Organizations have arranged different standards for right shares sectorally, including for the financial sector and non-financial sector. Nowadays, instead of discouraging such a trend by bringing companies that have announced rights shares in violation of the said provision, the board has been found to have put them in the pipeline for issuing rights shares and even sent letters.

Considering the situation where investors are burdened with the burden of the company’s debt by companies that make such announcements, ignoring the compliance status of the provisions of the securities law, there is no doubt that the rights share is a trap.

It seems that there is a large number of investors in the secondary market of Nepal who understand rights shares as dividends. Looking at the decision, which is giving a direct challenge to the securities law, it has exposed the poor state of good governance and compliance of these companies.

Legal provisions related to the issue of rights shares:

In the provisions related to the issue of rights shares of a company, Section 2(m) of the Securities Act, 2063 defines a proposal made to purchase any securities issued by a corporate body by the existing shareholders or any person nominated by them as a rights issue. The provisions related to the conditions for obtaining the issue of shares are seen in the Securities Registration and Issuance Regulations, 2073. Under the provisions related to the issue of rights shares of securities, Rule 17(1) states that if a corporate body wishes to increase its capital by issuing securities to existing shareholders on the specified date, it may issue rights shares of securities, 1(a) states that the proposal should be submitted to the general meeting within a maximum of two months from the date of the decision to issue rights shares by the board of directors of the corporate body, and (1b) states that the corporate body should submit an application to the board along with the necessary documents and details within two months of the decision to issue rights shares by the general meeting.

Similarly, additional provisions related to this are also made in the Securities Issuance and Distribution Guidelines, 2074 BS regarding the issue of rights shares by sector, in which different criteria are provided for the financial sector and the non-financial sector.

In which, under the conditions to be fulfilled for the issuance of right shares in Section 12 of the Directive for the banking, financial or insurance sector, an incorporated body may issue right shares only once in a financial year under Sub-section (2). While issuing right shares in this way, one hundred and eighty days must have passed from the date of listing of the shares issued last time in the stock market. However, it seems that this provision will not apply in cases where capital has to be increased as per the directives of the regulatory body. Sub-section (3) states that if a corporate body has to issue right shares due to regulatory provisions related to its business, it must have passed a resolution to issue right shares at the general meeting stating the reasons for the same, Sub-section (9) states that the corporate body must submit an application to the board within two months of the decision to issue right shares at the general meeting, and Sub-section (10) states that if the corporate body decides to issue right shares at the general meeting, that decision must be implemented compulsorily.

Similarly, for the non-financial sector, Section 13 provides for the issue of right shares by listed corporate bodies other than banks, financial institutions or insurance companies. In which, in Sub-section (1), it is seen that if a listed corporate body other than a corporate body engaged in banking, financial or insurance business invests the proceeds from the issue of right shares in such corporate body or a corporate body-promoted project or a project promoted by another company or subsidiary company, the following conditions must be met: (a) A clear financial plan and strategy regarding the issue of right shares and the utilization of the total amount received from such issue and the grounds for justifying the right share ratio to be issued have been approved by the general meeting, and (b) At least two years have passed since the initial public offering.

How did the announcement of right shares by these companies violate the securities laws?

##

## Among the above-mentioned laws, the distortion that affects the secondary market price of the company by declaring rights shares before the specified period has been completed. Even as the Nepali securities market is booming, the morale of such listed companies seems to have increased as the board, the body that should play a regulatory and supervisory role, has become complacent.

##

## Guardian Micro Life Insurance Company Limited has come in line to violate the law by declaring rights shares in this way. The company has recently decided to issue 100 percent rights shares by holding a special general meeting. The company received a public offering of Rs. 225 million from the Securities and Exchange Board of Nepal on 2081 Mangsir 7 and was listed on the Nepal Stock Exchange only on 24 Magh 2081. However, after the board of directors approved the issuance of rights shares and published a notice on 2081 Chaitra 2, a debate has started among stock market investors regarding this.

The company, which had a paid-up capital of Rs 750 million at the time of obtaining its license from the Nepal Insurance Authority, has acted contrary to the provision of Sub-section (2) of Section 12 of the Securities Issuance and Distribution Directive, 2074 BS, which states that a company can issue right shares only once in a fiscal year, and thus, when issuing right shares, 180 days must have passed from the date of listing of the shares issued last time in the stock market. This has affected the secondary market price of the company and the company’s price has reached above Rs. 2400. It is important for anyone to understand that the right share announcement made without being in a position to get approval by a company that has not complied with the conditions stipulated in the rules and regulations is a manipulation of the price. Similarly, there is a large group of investors who express the opinion that it is not clear why the company needed recapitalization when the micro insurance program is not effective.

It is found that companies in the hydropower sector are at the forefront of announcing rights shares in violation of the securities law. This is also clear from the list of companies awaiting permission to issue rights shares published by the Securities and Exchange Board of Nepal. The fact that the company has been written to in the notes section of the list indicates that the board has agreed to this. Such companies include River Flush Power Ltd. and Barahi Hydropower Company. It is clear from the list of the board’s pipeline of rights shares that both these companies have challenged the provision of at least two years after the initial public offering in Sub-section 1(b) of Section 13 of the Securities and Exchange Commission Directive, 2074 BS.

Similarly, Nepal Warehousing Company, a listed company that received permission to issue 137.5 million on Kartik 10, 2080, was duly listed on Nepse on Poush 4, 2080. According to the legal provisions related to securities, the company finally completed the period specified for issuing rights shares two years from that date, i.e. by Poush 3, 2082. However, the company seems to have challenged the said rule to influence the secondary market price and passed the rights shares at the special general meeting on Kartik 7, 2081. What is clear from these examples is that instead of taking action against such companies and their directors, the board is playing around, which clearly puts the investors’ investments at risk.

Making net worth by selling at auction

Looking at the recent situation of the remaining right shares after the issue of right shares, it is seen that a large amount of shares of most companies are not sold but are auctioned, and it is clear that the companies have vested interests in this too. In this regard, in Section 15 of the Securities Issuance and Allotment Guidelines, 2074 BS, in the provision for auctioning of right shares, sub-section (1) provides that if all the shares cannot be sold within the period opened for sale of right shares and there are remaining shares, the concerned corporate body shall publish a public notice for auctioning of such remaining shares within seven days of the allotment.

Out of the 8 companies that received approval to issue rights shares in the fiscal year 2081. 82, it seems that 5 companies have already issued rights shares. It seems that most of the companies have auctioned a large amount of shares, Life Insurance Company Ltd. 492,500 shares, NLG Insurance Company Ltd. 29,977 shares on the promoter side and 290,555 shares on the ordinary share side, Liberty Energy Company Ltd. 826,574 shares, Balefi Hydropower Ltd. 676,191 shares on the promoter side and 588,892 shares on the ordinary share side and Ngadi Group Power Ltd. 873,610 shares. Thus, the amount received from the auction can be used by the company only for distributing bonus shares. It seems that the company’s non-business assets have increased with this amount, and its impact is being increased in the secondary market of securities by washing away the bad net worth and showing a high net worth.

The company that announced the right share in violation of the securities law is understood to have announced the right share as a weapon to increase the price in the secondary market of securities.

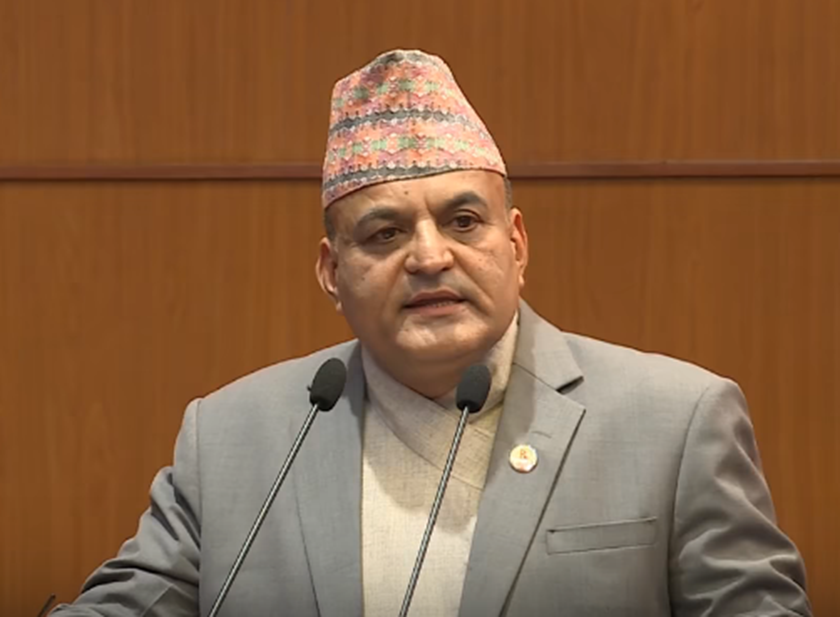

After Santosh Narayan Shrestha assumed the responsibility of the chairman of the Securities and Exchange Board of Nepal, the directors of listed companies seem to be becoming more chaotic. Due to the silence of the board leadership, the self-confidence of cornering and insider traders in the secondary market has not only increased, but they are running like unbridled horses

प्रतिक्रिया दिनुहोस्