Kathmandu. There has been improvement in the collection of value-added tax (VAT) and excise duty on the internal revenue side. However, there has been a problem in the collection of income tax.

According to the data of the Ministry of Finance, in the first 6 months of the current year, the collection under the excise duty heading has increased by 20.86 percent compared to the previous year. There has been a 16.90 percent progress towards VAT.

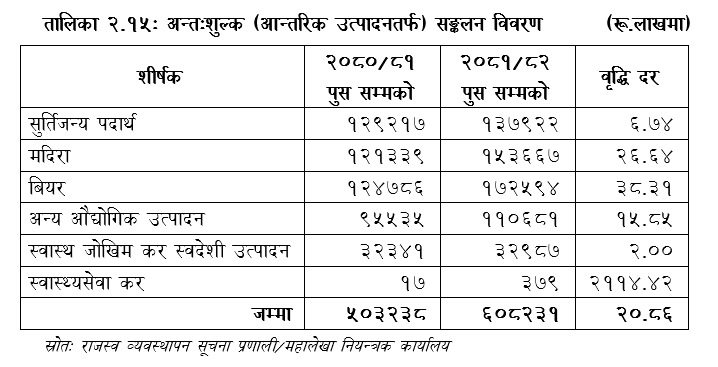

The excise duty heading, which had been negative in previous years, has shown significant improvement this year. Compared to last year, there has been a progress of 6.74 percent in tobacco products, 26.64 percent in alcohol, 38.31 percent in beer, 15.85 percent in other industrial products, 2 percent in health risk tax on domestic products, and 2114.42 percent in healthcare tax.

In the past years, tax collection from the alcohol industry had decreased due to the increase in the use of fake excise duty. This time, the Internal Revenue Department has tightened the use of fake excise duty stickers. Therefore, progress has been seen in this heading.

During the review period, a total of Rs. 83.3885 billion in excise revenue was collected, including Rs. 60.823 billion from domestic production and Rs. 22.565 billion from imports. Compared to the same period of the previous fiscal year, there has been an increase of 20.86 percent in domestic excise and 23.03 percent in import excise. This has increased the overall excise duty collection in the current fiscal year by 28.86 percent compared to the previous fiscal year.

Similarly, some progress has been seen in the VAT sector. In the past years, there has been a partial improvement in the use of fake VAT bills. During the review period, there has been a progress of 10.51 percent in production. There has been a negative growth of 13.80 percent in the sale and distribution of goods, 3.43 percent in consulting and contracting. 42.35 percent in tourism services, 63.1 percent in communication services, insurance, aviation and other services, and 1.72 percent in collection from unregistered persons. Value Added Tax (VAT) received from sources other than distribution has increased by 5.02 percent.

During the review period, a total of Rs. 154 billion 848.6 million was collected as Value Added Tax, of which Rs. 64 billion 751 million was collected domestically and Rs. 90 billion 975 million was collected from imports.

Problems in Income Tax

While the department has made some progress in VAT and excise duties, it has not been able to improve income tax. During the review period, income tax collection amounted to Rs. 141.9383 billion. This is 4.33 percent more than the collection of Rs. 136.487 billion in the same period of the previous fiscal year. Under income tax, Rs. 60 billion 830 million 140 thousand have been collected towards corporate income tax, Rs. 50 billion 990 million 750 thousand have been collected towards personal income tax and Rs. 27 billion 370 million 740 thousand have been collected towards investment income tax.

Compared to the collection for the same period of the previous fiscal year, the growth towards corporate income tax has been negative by 11.90 percent, while personal income tax has been positive by 21.18 percent and investment income tax has been positive by 10.74 percent.

In terms of corporate income tax, revenue collection from government companies and public limited companies has decreased by 18.15 and 35.29 percent respectively compared to the previous fiscal year, while income collection from private limited companies and other companies has increased by 36.67 and 7.91 percent respectively.

Compared to the previous fiscal year, the capital gains tax on personal income tax increased by 99.05 percent, the income tax on sole proprietorship by 7.84 percent, and the social security tax by 2.67 percent, while the wage tax was negative by 2.17 percent.

During this period, the capital gains tax on investment, tax on other income, tax on dividends, tax on income from property, rent and lease, and tax on other investment income increased by 637.44, 28.72, 18.60, 12.01, and 5.86 percent, respectively, while the tax on interest and tax on incidental investment gains were negative by 14.70 and 99.97 percent, respectively. According to an employee of the Office of the Auditor General, who is assigned to audit the internal revenue offices, the tax offices have now weakened the inspection of income tax. The employee told Singha Durbar, “Although there has been some improvement in VAT on the internal revenue side, the crisis in income tax has started to deepen, the problem is increasing due to discretionary expenditure deductions, we have found that tax offices are now targeting income tax.”

प्रतिक्रिया दिनुहोस्