Global IME Bank Limited has made rice farming loans public on the occasion of National Rice Day. The bank has made rice farming loans public with the aim of supporting the strategy taken by the Government of Nepal in the budget statement for the fiscal year 2082/83 to make the country self-reliant in rice in the next 2 years.

Under this scheme, farmers will get loans of up to Rs. 2 million from the bank to purchase rice seeds, chemical and organic fertilizers, agricultural equipment and other necessary agricultural inputs. This loan scheme has been made public to encourage farmers to make agriculture a dignified and professional profession by cultivating rice to make the best use of cultivable land.

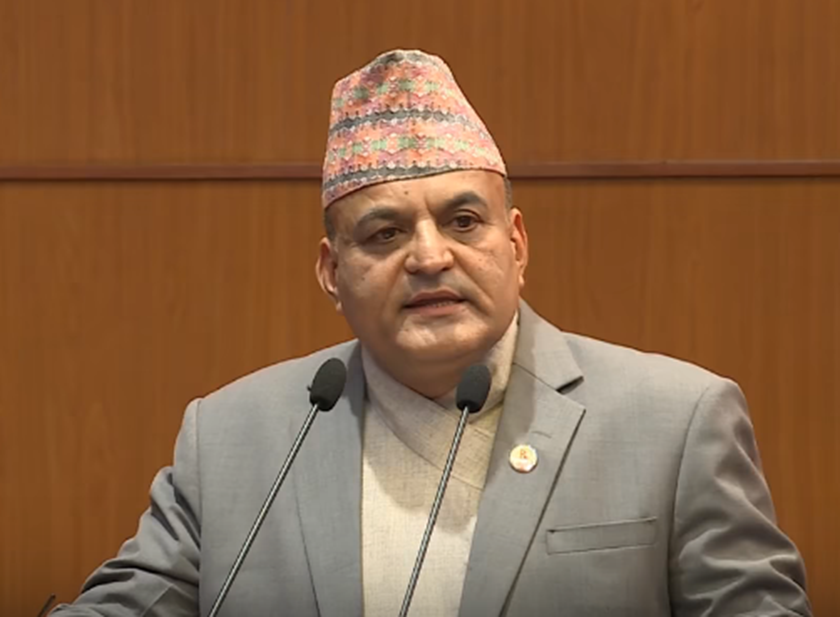

Also, on the occasion of National Rice Day, the bank has provided loans to Tokha Municipality Ward No. 1, A paddy plantation has been organized in a field near Radha Krishna Temple with the participation of bank employees and locals. The program was attended by bank employees and locals, including bank CEO Surendra Raj Regmi.

Speaking at the program, bank CEO Regmi mentioned that the bank organizes such programs to increase paddy production, modernize and commercialize agriculture in accordance with the strategy of the Government of Nepal to increase the morale of farmers.

Also, he expressed his belief that the paddy cultivation loan announced by the bank today will also encourage farmers to cultivate paddy and will also help in increasing paddy production. Keeping in mind the convenience of its customers, the bank has been attracting customers by introducing various time-related schemes.

Global IME Bank is the bank that has been honored as the best bank in Nepal in two categories under Global Finance’s Best Bank Award 2024 and Euro Money Award for Excellence 2024. Global IME Bank has also been honored in different categories by various national and international organizations.

Global IME Bank is the first private sector commercial bank with a branch network in all seventy-seven districts of the country. The bank has been providing excellent service to its customers from more than 1,000 service centers, including 352 branch offices, 385 ATMs, 158 branchless banking services, 68 extension and revenue collection counters, and 3 foreign representative offices.

In addition to providing banking services to Nepali citizens, the bank has also been providing remittance services from various countries around the world. The bank has been working to receive remittances from the United States, the United Kingdom, Canada, Australia, Malaysia, South Korea, Japan, Saudi Arabia, Qatar, UAE, Bahrain, Kuwait, India, Jordan, and other countries.

प्रतिक्रिया दिनुहोस्