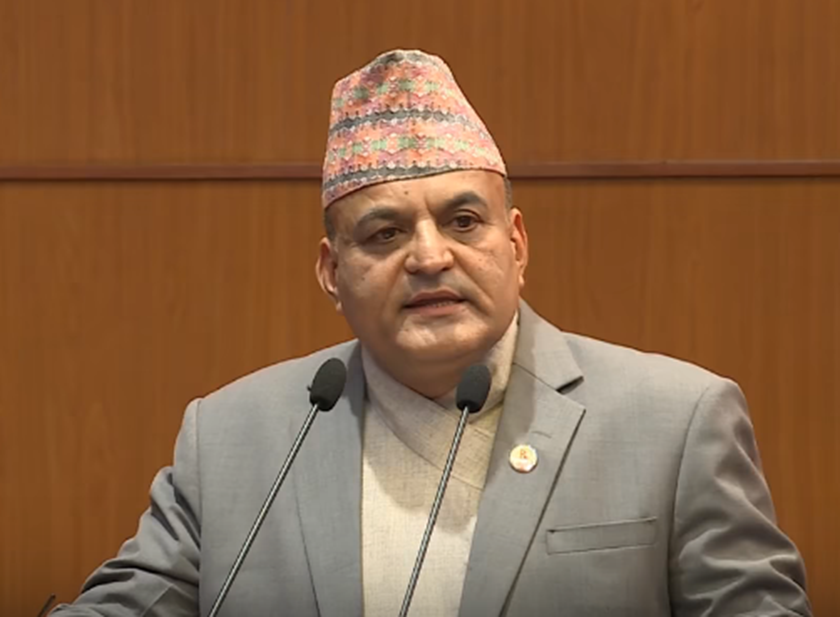

Kathmandu. At present, the entire team of the National Bank is busy preparing the monetary policy. The newly appointed Governor Dr. Bishwanath Poudel has returned after completing his field visit from Jestha 22 to Jestha 26, saying that he will collect suggestions from the grassroots level.

Based on the suggestions received from across the country, the National Bank team is preparing to finalize the monetary policy for the upcoming fiscal year 2082/083.

The Nepali capital market has got a market-friendly Finance Minister and Governor of the National Bank after a long time. After Bishnu Prasad Poudel was appointed as the Finance Minister on Asad 30, 2081, the stock market had reached the 3,000-point mark from 2,000.

Finance Minister Poudel is presenting the budget for the upcoming fiscal year in the parliament on Jestha 15. The budget has come in favor of the stock market. Because while the capital gains tax on short-term transactions in India has reached 20 percent, only 7 percent has been implemented in Nepal.

Similarly, Governor Poudel has also started making policy changes for market reform. Governor Poudel had conducted the third quarterly review of monetary policy on Jestha 11. The review has reduced the risk weight on share-backed loans to 100 percent.

The review has reduced the risk weight on share-backed loans from 125 percent to 100 percent.

Chhotelal Rauniyar, former president of Nepal Investor Forum, told Singha Durbar that if monetary policy can be improved, it will help market development.

He said, “Liquidity in banks is low, interest rates are low, even though banks have money, they are not able to work, there are very few people taking loans, there is no point in imposing a cap of 150 million.” He has demanded that the limit of 150 million personal loans be removed from the monetary policy. .

The second thing that should be included in the monetary policy is to abolish the cap on microfinance to give 15 percent dividend, Rauniyar said.

He said, “The NRB is a regulator, not a controller. Everyone should accept that the NRB can do the work of a regulator, but it is not good to say that you only give this much as you earn. It seems like you are coming out of your field and controlling.” That is why the condition of microfinance is bad.’

He added, “The NRB should remove the rule that only 15 percent dividend can be given and that it cannot be given. After a company earns, it calculates its expenses and keeps reserves according to the rules. If it earns, it pays, if it doesn’t, it doesn’t pay. The NRB should not put restrictions on it.”

Similarly, earlier banks used to trade shares and there was a provision to buy 3 percent shares from core capital. Rauniyar said that the money received from it used to give dividends to investors, and the income of the banks has been decreasing since the NRB tightened its grip on them.

Rauniyar added, “As the income of the banks has been decreasing, the founding shareholders have been selling shares in a hurry. In the previous fiscal year, 9 banks could not give any dividends to investors. The reason why the banks could not rise in the stock market is because of the wrong policies and regulations of the NRB.”

He added, “When the Finance Minister said that the stock market is a mirror of the economy, and the Prime Minister said that it is a mirror of the economy in Parliament, we had to look with a little more open eyes. The NRB should also come up with a clear policy.”

Similarly, in share-backed loans Tara Prasad Fullel, acting president of the Nepal Stock Investors Association, told Singha Durbar that the market has not been able to recover due to the 15 percent cap imposed on investors.

Similarly, he said that the cap imposed on microfinance dividends should be abolished and the path for banks and financial institutions to invest in the stock market should be eased.

He said, “If all this is removed in the monetary policy, the buying side in the stock market will be strong.”

Four capital market related investor associations have jointly met Governor Poudel and submitted their suggestions.

Current fiscal year In his budget speech for 2082/083, Finance Minister Bishnu Poudel announced that NRNs will be allowed to invest in the secondary market. He said that the government will also allow non-resident Nepalis to trade shares.

The budget for the upcoming fiscal year has already made provisions to allow non-resident Nepalis to invest in the stock market.

The flow of share collateral loans (margin-type loans) from banks and financial institutions is increasing. With the increase in the number of big investors who take loans from banks and invest in the stock market, the flow of share collateral loans from banks is increasing. Commercial banks have disbursed 137.7 million share collateral loans in the 10 months of the current year.

प्रतिक्रिया दिनुहोस्